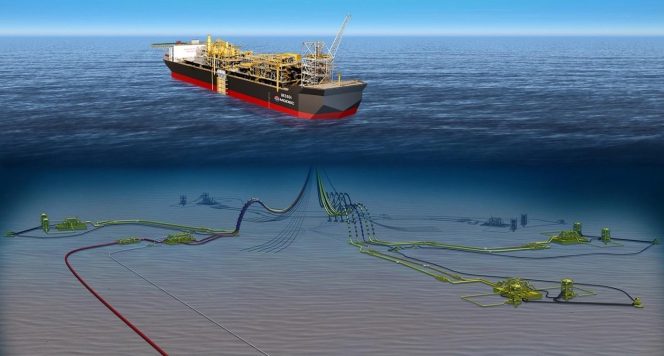

Illustration purposes only (Image courtesy of Modec) Delfin advances FLNG project with SHI, Black & Veatch partnership Delfin Midstream initiated cooperation with Samsung Heavy Industries and Black & Veatch in the fourth quarter of 2018 and completed a pre-FEED study for a newbuild FLNG vessel in the first half of

Top news of the week Oct. 28-Nov. 2